Synchrony Financial (SYF)·Q4 2025 Earnings Summary

Synchrony Q4 Beat Overshadowed by Flat 2026 Guidance — Stock Falls 4%

January 27, 2026 · by Fintool AI Agent

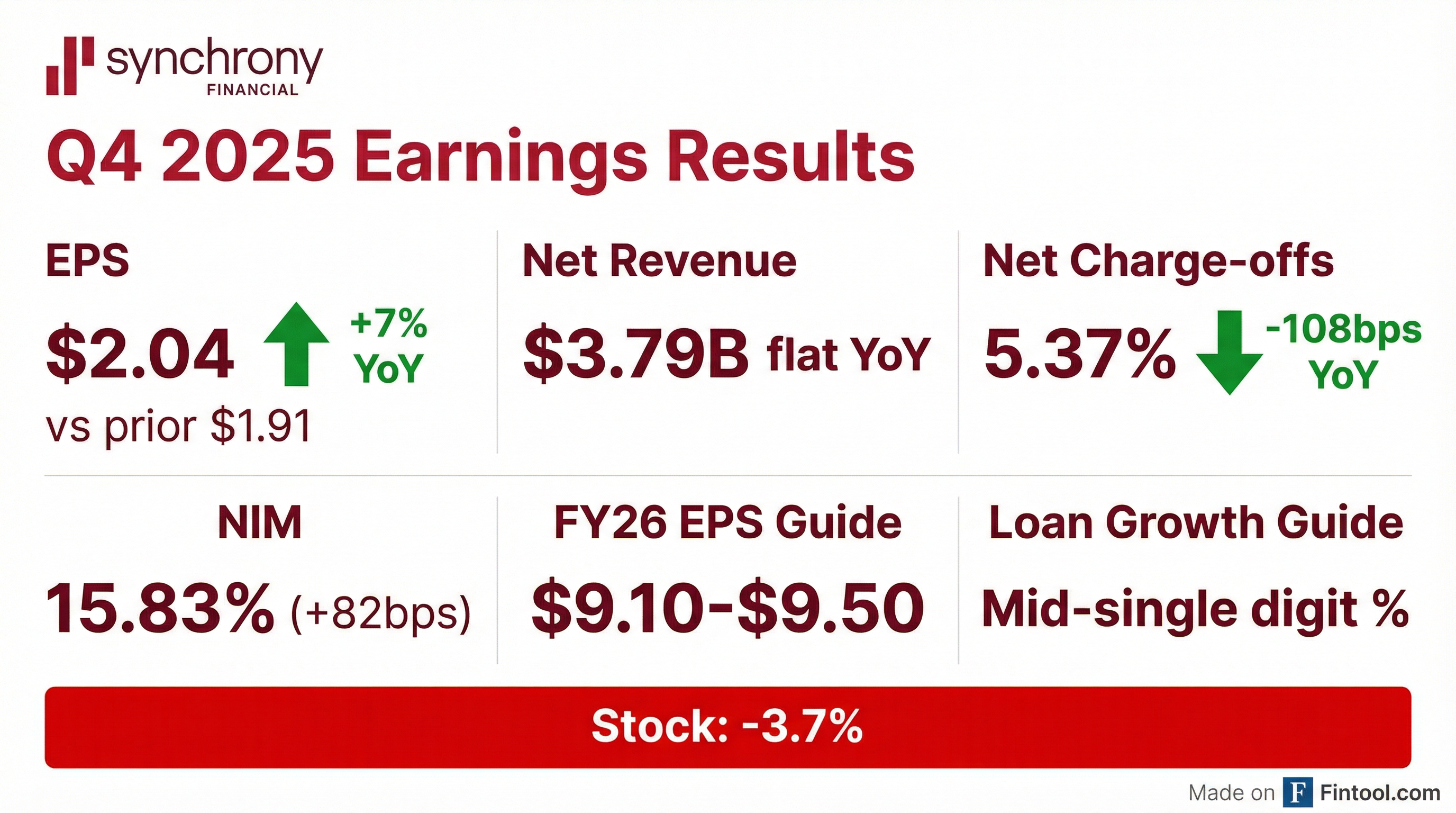

Synchrony Financial reported Q4 2025 EPS of $2.04 (+7% YoY) this morning, but shares fell nearly 4% as investors digested 2026 guidance of $9.10-$9.50 — essentially flat versus 2025's $9.28 despite expectations for mid-single-digit loan growth . The disconnect: heavy CECL reserving on new programs like Walmart and Lowe's is creating a near-term earnings headwind .

The quarter's headline story: credit normalization. Net charge-offs fell 108 basis points to 5.37%, returning to within management's long-term target range . CEO Brian Doubles called the Walmart One Pay partnership launched in September "the fastest-growing program we've ever launched" , while consumer spending trends accelerated in early January .

Did Synchrony Beat Earnings?

Synchrony delivered solid results that reflected ongoing credit normalization and disciplined execution:

The reported EPS of $2.04 includes approximately $0.14 from restructuring costs related to a voluntary early retirement program. Excluding this charge, adjusted EPS would have been approximately $2.18 .

Full Year 2025 Results: Net earnings of $3.55 billion, up 1.5% year-over-year, with diluted EPS of $9.28 versus $8.55 in 2024 .

What Did Management Guide?

Management provided 2026 outlook that reflects confidence in the normalized credit environment:

Key Assumptions :

- Unemployment rate of 4.8% by year-end 2026

- GDP growth of 2.0%

- Fed Funds rate of 3.25% by year-end

- Deposit betas of approximately 65%

- No regulatory or legislative changes

- Stable macroeconomic environment

CEO Brian Doubles highlighted the strategic positioning: "Synchrony has built a legacy of driving strong results amid an ever-evolving landscape, solidifying our leadership as a partner of choice and positioning us well for 2026 and beyond, assuming normal operating conditions."

What Improved This Quarter?

Credit Quality — The Big Story

The credit improvement was the quarter's most significant development:

CFO Brian Wenzel noted: "The combination of our underwriting discipline and the efficacy of our credit actions have returned our portfolio to within our target net charge-off range of 5.5 to 6.0%."

Notably, all three delinquency and charge-off metrics are now below pre-pandemic averages (2017-2019), indicating the credit cycle has fully normalized .

Net Interest Margin Expansion

NIM expanded 82 basis points to 15.83%, driven by:

- Loan receivables yield increased 53bps to 21.80% from PPPCs (Product, Pricing, and Policy Changes)

- Interest-bearing liabilities cost decreased 51bps to 4.07% from lower benchmark rates

- Liquidity portfolio yield declined 73bps to 4.03%

Capital Return

Synchrony returned $1.1 billion to shareholders in Q4 :

- Share repurchases: $952 million (13 million shares)

- Common dividends: $106 million

- Remaining buyback authorization: $1.2 billion through June 2026

Book value per share grew 13% to $44.74; tangible book value per share increased 9% to $37.21 .

How Did Each Platform Perform?

Synchrony operates through five sales platforms with diverse retail partnerships:

Digital was the standout, with purchase volume up 6% driven by higher spend per account and strong customer response to enhanced product offerings .

Home & Auto remained weak, reflecting selective consumer spending in home improvement categories and lower average active accounts. The platform also included a $0.2B portfolio sale in the quarter .

What Are the Growth Catalysts?

Management highlighted several strategic initiatives for 2026:

Walmart One Pay — The Fastest Launch Ever

CEO Brian Doubles provided significant detail on the Walmart partnership launched in September 2025:

"The program is fully launched in market, really strong early results. Fastest growth we've ever seen in a de novo program."

Key differentiators:

- Leading-edge tech: Fully leveraging the One Pay app with Synchrony's API stack

- Strong value proposition: Walmart+ members get unlimited 5% cash back at Walmart, 1.5% everywhere else

- Digital-first: Entire experience inside the app from application through servicing

- Aligned incentives: Both parties incented to grow the program

Pay Later Strategy — 10%+ Sales Lift

Pay Later is now offered at 6,200+ merchants and showing compelling results :

"When we offer a pay later and revolving products together, we experience an at least 10% average increase in sales, pointing to the expansive purchase power Synchrony can deliver through our multi-product strategy."

Management confirmed the accounts are incremental, not cannibalizing existing private label or co-brand products:

"The volume flowing through private label and co-brand is very consistent, and the pay later accounts that we're getting are net new."

Pay Later terms are primarily 6-12 months, with some 18-24 month offerings. Below 6 months is avoided due to profitability challenges .

Other Growth Initiatives

- Lowe's Commercial Co-Brand — Expected to transfer to Synchrony's portfolio in Q2 2026

- Versatile Credit Acquisition — Accelerating multi-source financing strategy

- Bob's Discount Furniture — New exclusive multi-year agreement launching mid-2026

- RH and Polaris — Recent partner renewals

For the year, Synchrony added or renewed 75+ partners, including 7 of the top 20 . Approximately 97% of total interest and fees from top 25 partners are renewed through 2028 .

What Did Management Say About the Consumer?

CEO Brian Doubles expressed confidence in consumer health during the Q&A:

"Overall, we're pretty encouraged by what we're seeing in terms of the consumer. The consumer's been resilient all year, better than we expected. We're not really seeing any signs of weakness."

Early 2026 Momentum

CFO Brian Wenzel provided encouraging color on January 2026 trends:

"If you take that and extrapolate that into the first, you know, several weeks of 2026, we have accelerated the purchase volume beyond that rate [+3%]."

Holiday performance was also strong: "Our holiday partners, which make up about two-thirds of our portfolio, grew above a 4% rate."

Tax Refund Tailwind

Management highlighted potential benefit from elevated 2026 tax refunds:

"This tax refund season will be one of the largest, if not the largest, that we've seen... Some people say between $500 and $1,000 incremental refunds off of an average refund of $3,000-$4,000."

Timing: 50-60% of refunds arrive by mid-March, 80-90% by May . The benefit is included in guidance.

APR Cap Commentary

When asked about potential 10% APR caps, CEO Doubles pushed back strongly:

"Any price controls, like an APR cap, would not make credit more affordable. It would eliminate credit for those that need it... We support 400,000 small to medium-sized businesses who depend on those credit programs. In some cases, we can be over 40% of their sales, so this would be a huge hit for them."

What Is Management's Credit Appetite?

CFO Wenzel clarified credit positioning during the Q&A:

"No incremental broad-based changes are assumed for 2026 as we enter the year. The actions that we took in the end part of 2025 are in the guide."

Key points on credit:

- 2023-2024 credit actions (student loans, personal loans) remain in place

- Watching probability of default across all credit grades — elevated vs. historical norms

- Tighter positioning at lower FICO scores (650-700 range)

- Credit aperture expansion possible if macro and portfolio trends remain favorable

What Are the Key Risks?

Management flagged several risks:

- Macroeconomic Sensitivity — Consumer confidence, inflation, interest rates, and potential recession

- Regulatory Risk — Proposed 10% APR caps could "eliminate credit for those that need it" per CEO

- Payment Rate Behavior — Elevated at 16.3%, up 155bps vs pre-pandemic, compressing loan growth

- Partner Concentration — Revenue concentrated in a small number of retail partners

- Growth Investment Drag — CECL reserving on new programs (Walmart, Lowe's) creates near-term earnings headwind

The efficiency ratio increased to 36.9% from 33.3%, though 180bps was attributable to restructuring costs . Other expenses grew 10% to $1.4B, driven by employee costs and technology investments .

How Did the Stock React?

Synchrony shares sold off following the earnings release despite the EPS beat:

The negative reaction likely reflects investor concerns about the 2026 EPS guidance of $9.10-$9.50 being roughly flat year-over-year (vs. FY 2025 EPS of $9.28), despite expectations for mid-single-digit loan growth. The stock is trading well below its 52-week high of $88.77 but has doubled from its 52-week low of $40.55.

Q&A Highlights

On 2026 EPS Guidance (Flat YoY Despite Growth)

CFO Wenzel explained the disconnect between mid-single-digit loan growth and flat EPS:

"What you are seeing is some of the early growth in some of the programs where you have the heavy reserve rate, when you have assets that are not yielding as much because they're just in the early stage of the J curve."

The "significant investments" in growth primarily impact the reserve line (CECL), with smaller impacts across yield, other income, and expenses — each less than 10 basis points but cumulative .

On Reserve Rate Trajectory

"If you believe the macro environment becomes stable, at what point can the qualitative reserves come down? We're the closest to we've been to day one [CECL]."

Reserve rate has downward bias if macro conditions remain stable.

On Pay Later Profitability

"We do not do a lot of volume and don't really push anything below six months. It's hard to make money, or it's really impossible to make money in the pay it forward and stuff like that."

Most Pay Later volume is in 6-12 month terms, similar to private label turn characteristics.

On Why Not Widen Credit Faster

"Probability of default across credit grades is higher than historical norms... We benefit because of our line structures and our ability to maintain a lower line structure and control that exposure at default."

Long-Term Track Record

Management highlighted Synchrony's consistent returns through various credit cycles :

The company has navigated multiple credit cycles since the Great Financial Crisis, including the CARD Act implementation, COVID-19 pandemic, and the recent rising rate/credit loss environment .

Key Takeaways

- Credit Normalization Complete — Net charge-offs at 5.37% returned to target range, below pre-pandemic levels

- Walmart Launch Exceeding Expectations — "Fastest-growing program we've ever launched" with strong digital integration

- Flat 2026 EPS Despite Growth — CECL reserving on new programs creates near-term headwind; EPS growth should reaccelerate beyond 2026

- Consumer Resilient — "Better than we expected" per CEO; purchase volume accelerating into 2026

- Pay Later Working — 10%+ sales lift when offered with revolving products; accounts are incremental

Data sourced from Synchrony Financial Q4 2025 8-K filing and earnings call transcript dated January 27, 2026. This analysis is for informational purposes only and does not constitute investment advice.

Related: SYF Company Profile | Q4 2025 Transcript | Q3 2025 Earnings